How can we help?

To access legal support from just £145 per hour arrange your no-obligation initial consultation to discuss your business requirements.

If you or your business is struggling to keep up with payments or you want to wind up your affairs efficiently and cost-effectively, we can help you find the best solution. By sharing our in-depth knowledge and experience of insolvency and business recovery processes, we can help you choose a recovery or exit strategy that’s right for you. We also support insolvency practitioners, creditors and individuals facing financial problems.

Our team of corporate recovery and insolvency solicitors will:

Provide you with some breathing space and protection from your creditors by considering with you whether administration is the right option for your business.

Whether your company is ultimately sold, liquidated, or continues trading, an administration order can often be the best way of dealing with a company in financial difficulties. We can help you through the process.

Offer guidance and act quickly on your behalf if you’ve been served with a statutory demand or winding-up petition by a creditor, or if a receiver has been appointed over your company.

We’ll make sure the situation is resolved as quickly as possible so that you can get back to business.

Explore the potential of a Company Voluntary Arrangement

To ensure that your relationship with your creditors is put back on track without the need for winding up or other formal insolvency processes.

If compulsory liquidation by a creditor is unavoidable, help ensure you and your stakeholders emerge from the process as painlessly as possible.

If you’re considering whether a creditors’ or members’ voluntary liquidation might be the right option for your company

We can explain the process to you and support you through the procedure.

If you’re a director or shareholder of a company and you are concerned about protecting your personal position on an future insolvency event.

We can go over the risks and put in place some methods of avoiding personal liability as a director of an insolvent company.

If you’re a director faced with personal proceedings against you following an insolvency situation

Including claims by an insolvency practitioner, or a claim against you for directors disqualification we can explore your options and act on your behalf.

For insolvency practitioners

We’ll offer hands-on and practical support with the legal side of your work.

For creditors

We can provide advice and act for you on the best options to recover your debt.

For individuals facing bankruptcy

We can advise on your personal position and act on your behalf so that you get back on your feet as soon as possible.

Even extremely successful businesses can hit a bad patch. And most entrepreneurs have seen a business fail at least once. It comes with the territory. Whatever the level of difficulty your business is currently facing, our expert insolvency solicitors and corporate recovery lawyers can help. Liquidation isn’t inevitable, and there are numerous options open to you, from an administration order from which your business may emerge intact, to a Creditors Voluntary Arrangement where your debts can be rescheduled. We have helped businesses of all sizes get back on their feet and move on after financial distress.

Being in financial trouble is bad enough, but things can escalate quickly if you ignore important documents. Unpaid creditors owed as little as £750 can issue you with a statutory demand that, if not responded to promptly, can lead to your assets being frozen. If you’ve become reluctant to open your mail, please call us in – we have considerable experience dealing with creditors and insolvency law, and we can take some of the weight off your shoulders.

Insolvency is not the end of the road for all companies. Many come out of Administration able to trade and on good terms with their creditors. Understanding what your options are and the potential for a positive outcome is critical when you are facing a potential insolvency situation, and we’ve got the expertise to help you explore your choices before and during the Administration procedure.

Even if you’ve got cash flow problems, approaching your creditors proactively can reap rewards. We can help you find a mutually satisfactory arrangement that keeps creditors on board, whether that’s via a Creditors Voluntary Arrangement, or an information agreement.

Directors can become personally liable for decisions taken in the period preceding insolvency, and this can lead to orders for financial compensation to be paid, and even criminal proceedings. If you are concerned that your company is, or may become, insolvent, please get in touch, and we can provide your board with guidelines on permissible transactions, pre-insolvency, and how best to protect both you and your creditors to avoid any issues for the directors on a formal insolvency situation

Our team can take the stress out of a formal winding up and help you complete the formalities in a cost-effective and streamlined way.

We completely understand that when you’re confronted with financial difficulties, as an entrepreneur or key stakeholder, getting the necessary legal advice can help keep you afloat long enough so that you can find the best possible solution for your business, whatever that may look like. Our aim is to give start-ups the chance to access legal support that is more cost-effective and fuss-free when compared with traditional law firms. And with our legal subscription plans that’s exactly what you get: swift, budget-friendly access to an expert team of solicitors with the commercial acumen to advise you on the crucial next steps to take for your business.

Our insolvency solicitors can provide you with all the support necessary when you’re faced with financial hurdles. But as a fully integrated commercial law firm, we understand that businesses in difficulty often face a number of issues, from how to deal with redundancies and reorganisation, to finding ways to refinance debt.

In addition to our insolvency team, we have broad expertise in a number of complementary specialisms such as employment law where you may need to restructure your workforce, dispute resolution when you need help to manage your creditor relationships, corporate law for contractual or informal agreements with creditors, mergers and de-mergers, and banking and finance law for debt restructurings. Whatever your situation, our solicitors can offer holistic advice that’s tailored to you.

Find out more about the team here:

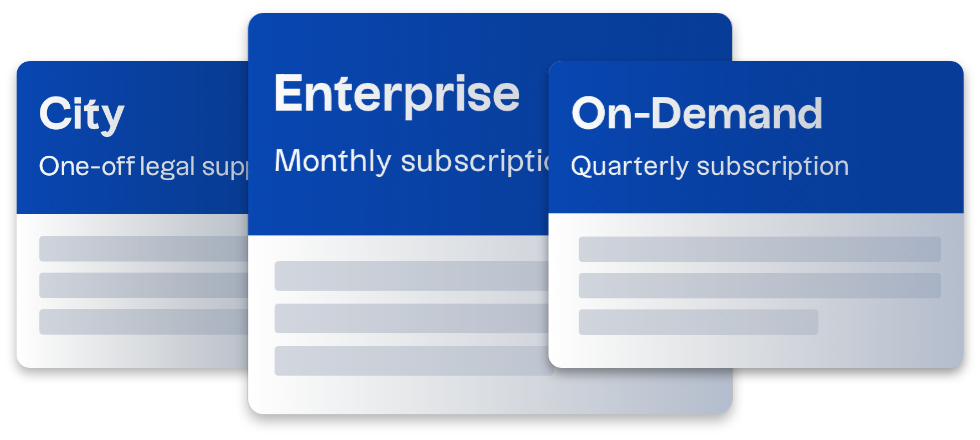

Pricing plans

Our three transparent pricing packages are designed to give you the widest possible access to high-quality legal advice, whatever the size and nature of your business:

Straightforward access to senior solicitors at a competitive rate.

An affordable solution for businesses needing one-off legal support. Receive ‘City’ partner-level expertise at a fraction of ‘City’ prices.

Have legal peace of mind for £215 per month with additional support from £145 per hour.

A monthly subscription legal support package specifically designed for start-ups and smaller businesses.

Providing you with priority access to a dedicated panel of highly experienced solicitors.

Fully account managed quarterly subscription service for businesses with more complex legal needs.

Please leave us your details and we’ll contact you to discuss your situation and legal requirements. There’s no charge for your initial consultation, and no-obligation to instruct us. We aim to respond to all messages received within 24 hours.

Your data will only be used by Harper James Solicitors. We will never sell your data and promise to keep it secure. You can find further information in our Privacy Policy.

Our commercial lawyers are based in or close to major cities across the UK, providing expert legal advice to clients both locally and nationally.

We mainly work remotely, so we can work with you wherever you are. But we can arrange face-to-face meeting at our offices or a location of your choosing.

To access legal support from just £145 per hour arrange your no-obligation initial consultation to discuss your business requirements.